The size and success of foreign banks in Germany are mostly the result of many decades of presence and active market cultivation in Germany. Some institutions have also experienced a surge in business growth as a result of Brexit by transferring business to their new or reorganised German units. As a result, the international banks operating in Germany have now achieved significant market shares in many business areas and have been able to maintain or expand these even in the difficult last few years. This is particularly true in trade finance, securities business and investment banking, where some of the VAB members are leading the market.

However, the importance of the members in the German market is not only measured by their relative size in absolute figures, but also by their commitment to the further development of the financial centre in all its dimensions. In 2023, the VAB once again channelled the ideas of international banks towards politics

and supervision. It should not be forgotten that many of the discussions and regulatory changes that take place in principle in Basel or at EU level and are then implemented or regulated in detail here in Germany are already significantly supported by the banking groups at international level. The professional perspective and expertise of the international institutions is brought in at an early stage.

For the VAB, the size and success of its members in the German market nevertheless play a role when it comes to exchanging with specialists and support in the Assocation’s work. Many members have grown to such an extent that they have built up substantial local staff departments, which can contribute the international professional perspective on regulation and supervision in Germany to the work of the VAB by being anchored in their institute groups. The size and success of the VAB members also play a role in making the justified demands and petitions of the international banks heard in the concert of the many stakeholders in politics and administration.

Click here for the yearbook.

Deutsche Version der Statistiken

You can find the statistics from the yearbook “Perspectives 2022/23” here.

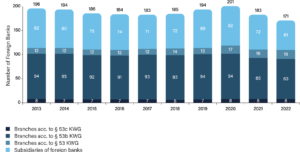

Number Foreign Banks in Germany

The number of foreign banks in Germany continues to decrease compared to the previous year due to consolidations in the

banking groups.

Source: Bundesbank/BaFin

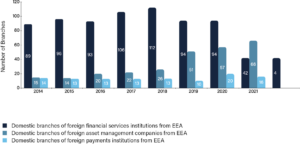

Number of Branches of EEA Foreign Financial Institutions (non-banks) in Germany

While the number of domestic EEA branches of foreign institutions has dropped as a result of Brexit, the number of domestic branches of foreign capital management companies from the EEA has increased significantly in 2022.

Source: Bundesbank/BaFin

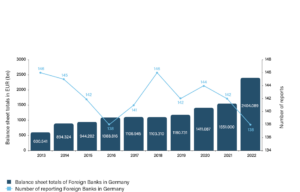

Number of BISTA reports and balance sheet totals of Foreign Banks in Germany as of reporting month December

While the number of reporting banks has decreased, the balance sheet totals of foreign banks in Germany have once again grown significantly in 2022, partly due to the Brexit effect.

Source: Bundesbank

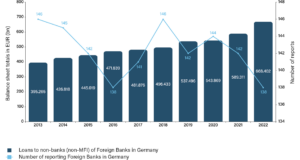

Number of BISTA reports and loans to non-banks (non-MFIs) of Foreign Banks in Germany as of reporting month December

Lending by foreign banks to non-banks in Germany has been rising steadily since the year 2013, with again a significant increase in 2022.

Source: Bundesbank

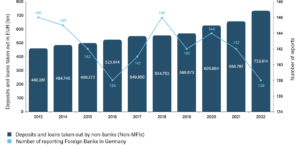

Number of BISTA-reports from foreign Banks compared with deposits and loans taken out by non-banks as at the reporting month December

Stable growth was recorded on the liabilities side of the foreign banks in 2022.

Source: Bundesbank

Volumes of share placings in Germany in 2022

In the year 2022, international banks continued to dominate the equity issuance business in Germany.

Source: Dealogic – with kind support of Deloitte

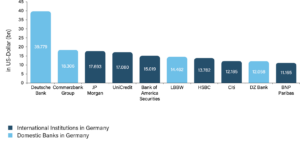

Volumes of bond issues in Germany in 20212

In the bond issuing business, international Institutions continue to hold their positions in the top 10.

Source: Dealogic – with kind support of Deloitte

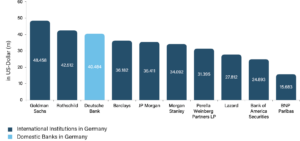

M&A in Germany in 2022

The market for mergers and acquisitions continues to be firmly in the hands of the international institutions, they account for nine out of ten of the most successful banks in this area.

Source: Dealogic – with kind support of Deloitte

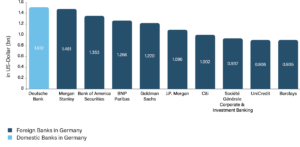

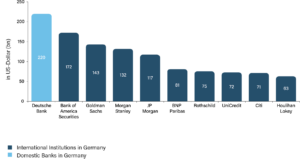

Investment banking fees in Germany in 2022

International Institutions continued to dominate investment banking in 2022. However, Deutsche Bank continued to hold the top position.

Source: Dealogic – with kind support of Deloitte

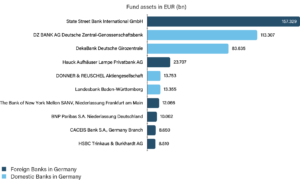

Depositories of securities funds (public funds)

The depositary business for mutual public securities funds in Germany continues to be led by a foreign bank in the year 2022, but German Custodians still dominate the top ten.

Source: BVI Bundesverband Investment und Asset Management e.V.

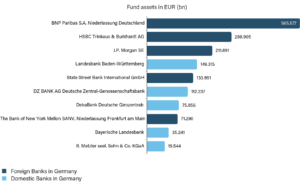

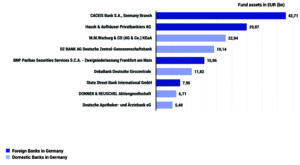

Depositories of securities funds (special funds)

Foreign banks continue to dominate the custody business for fund assets of German special securities funds in 2022.

Source: BVI Bundesverband Investment und Asset Management e.V.

Custodians of open real estate funds (public funds)

In the year 2021, foreign banks continue to have a large market share in custody for open-ended mutual property funds, but the top positions are still held by German banks.

Source: BVI Bundesverband Investment und Asset Management e.V.

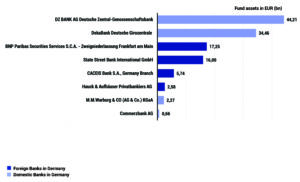

Custodians of open real estate funds (special funds)

Foreign banks continue to lead in the area of open-ended special real estate funds in the year of 2021.

Source: BVI Bundesverband Investment und Asset Management e.V.