The size and success of foreign banks in Germany are the result of decades of presence and active market engagement. Several institutions have experienced significant growth, particularly through the transfer of business operations following Brexit – most notably by establishing or transforming German entities. This success is reflected in the significant market shares that international banks have built and sustained over the years in Germany. Key sectors include trade finance, securities trading, and investment banking, where many VAB members are among the leading players.

Engagement Beyond Market Presence

The importance of international banks, however, is not solely defined by their size or absolute success. Their relevance is equally evident in their active commitment to advancing Germany’s financial centre across its many dimensions. In 2024, VAB once again served as the voice of international banks, contributing their ideas and proposals to policymakers and regulators. Many regulatory discussions and changes initiated at the Basel or EU level are closely followed by international banks from an early stage. This ensures that the technical perspective and expertise of these institutions are incorporated into decision-making processes – particularly when it comes to later implementation in Germany.

Success and Size as an Opportunity for Advocacy

The success and size of VAB members also play a crucial role in the association’s advocacy work. Many members have significantly strengthened their presence in Germany by building local support functions. These bring not only deep technical expertise but also an international perspective on regulation and supervision, enriching the VAB’s work.

Moreover, the scale and influence of the member institutions amplify the voice of international banks in Germany – especially in collaboration with other stakeholders and in dialogues with policymakers and public authorities.

Statistics Highlighting the “Footprint” of Foreign Banks

Below you find a selection of statistics illustrating the significance and presence of foreign banks in Germany. These are based on publicly available data, particularly from the Bundesbank, as well as figures compiled by VAB over many years.

In Summary: Foreign banks in Germany are not only significant economic players but also driving forces behind the development of Germany as a financial centre. Their market expertise and active involvement in the Association’s work contribute to shaping the regulatory and economic landscape for the benefit of all stakeholders.

Statistics on the importance and presence of foreign banks in Germany:

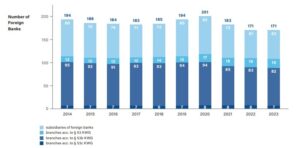

Number Foreign Banks in Germany

The number of foreign banks in Germany has remaines stable.

Source: Bundesbank/BaFin

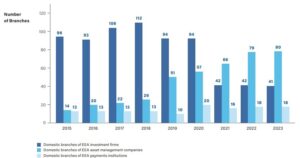

Number of Branches of EEA Foreign Financial Institutions (Non-Banks) in Germany

The number of domestic branches of EEA investment firms and of EEA capital management companies has stabilised at a new level since Brexit.

Source: Bundesbank/BaFin

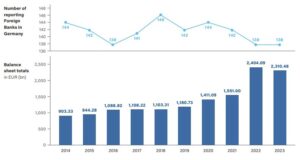

Number of BISTA Reports and Balance Sheets Totals of Foreign Banks in Germany as of Reporting Month December

While the number of reporting foreign banks has stabilised, the balance sheet totals at the end of 2023 have fallen slightly within the range of normal fluctuations.

Source: Bundesbank

Number of BISTA Reports and Loans to Non-Banks (Non-MFIs) of Foreign Banks in Germany as of Reporting Month December

Loans from reporting foreign banks to non-banks increased again in 2023 compared to the previous year, continuing the long-term trend of credit growth.

Source: Bundesbank

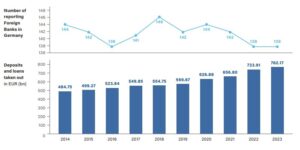

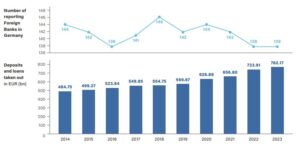

Number of BISTA-Reports from Foreign Banks Compared with Deposits and Loans Taken out by Non-Banks as at the Reporting Month December

The volume of deposits and loans taken out with foreign banks continued the long-term growth trend.

Source: Bundesbank

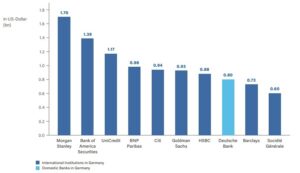

Volumes of Share Placings in Germany in 2023

As in previous years, the share issue business is firmly in the hands of foreign banks. They occupy 9 of the top 10 places.

Source: Dealogic – with kind support of Deloitte

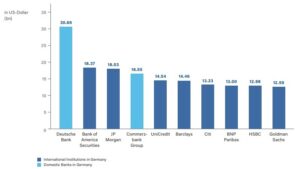

Volumes of Bond Issues in Germany in 2023

With the exception of the top position, foreign banks dominate the top 10 market participants in the bond issuing business

Source: Dealogic – with kind support of Deloitte

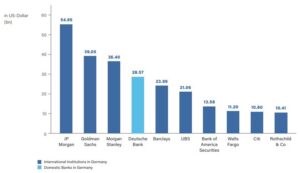

M&A in Germany in 2023

As in previous years, foreign banks clearly dominated the M&A business in 2023.

Source: Dealogic – with kind support of Deloitte

Investment Banking Fees in Germany in 2023

In terms of investment banking fees, there were significant changes in the top ten in 2023 compared to the previous year in favour of foreign banks, which were able to significantly increase their fee volume. Nevertheless, one German bank still just managed to take the top spot and another made it back into the top ten.

Source: Dealogic – with kind support of Deloitte

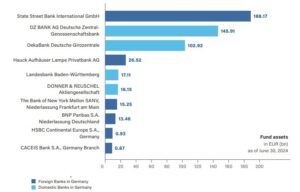

Depositories of Securities Funds (Public Funds)

As in previous years, one foreign bank holds the top position in the custody business for mutual securities funds.

Source: BVI Bundesverband Investment und Asset Management e.V.

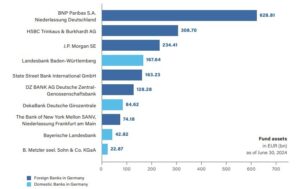

Depositories of Securities Funds (Special Funds)

As in previous years, foreign banks dominate the top ten in the custody business for special securities funds.

Source: BVI Bundesverband Investment und Asset Management e.V.