Click here for the yearbook.

Deutsche Version der Statistiken

You can find the statistics from the yearbook “Perspectives 2021” here.

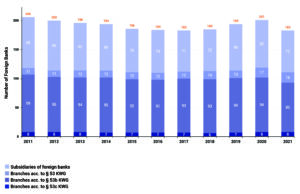

Foreign Banks in Germany

The number of foreign banks in Germany decreases compared to the previous year due to consolidations in the banking groups.

Source: Bundesbank/BaFin

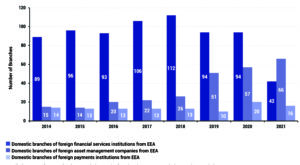

Branches of EEA Foreign Financial Institutions (non-banks) in Germany

The number of domestic EEA branches of foreign institutions has decreased compared to the year 2020. This is a consequence of the Brexit and (statistically) the introduction of the category of securities institutions.

Source: Bundesbank/BaFin

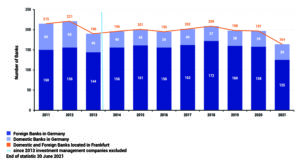

Domestic and Foreign Banks located in Frankfurt

Many foreign banks have chosen Frankfurt am Main as their location within Germany. Foreign banks account for about 3/4 of all banks located there.

Source: Bundesbank/BaFin

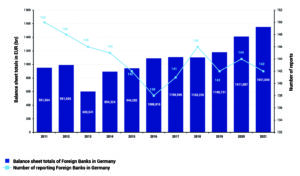

Number of BISTA reports and balance sheet totals of Foreign Banks in Germany as of reporting month December 2021

The balance sheet totals of foreign banks in Germany have continued to rise sharply compared to the year 2020, also due to the Brexit effects.

Source: Bundesbank

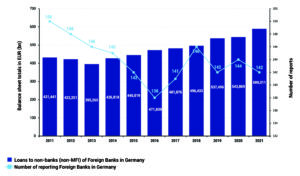

Number of BISTA reports and loans to non-banks (non-MFIs) of Foreign Banks in Germany as of reporting month December 2021

Lending by foreign banks to non-banks in Germany has been rising steadily since the year 2013, with a significant increase in the year 2021.

Source: Bundesbank

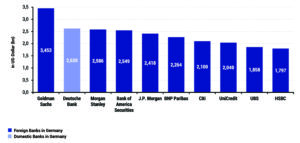

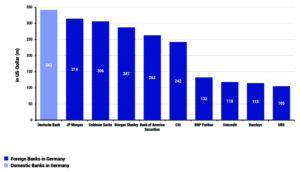

Volumes of share placings in Germany in 2021

In the year 2021, foreign banks continued to dominate the equity issuance business in Germany 2021.

Source: Dealogic – with kind support of Deloitte

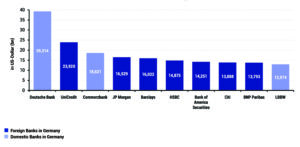

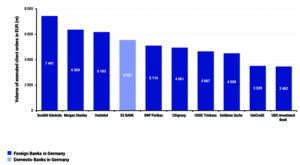

Volumes of bond issues in Germany in 2021

In the bond issuing business, foreign banks continue to hold their positions in the top 10, but German banks have expanded their positions compared to the previous year.

Source: Dealogic – with kind support of Deloitte

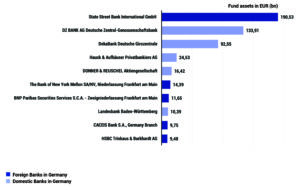

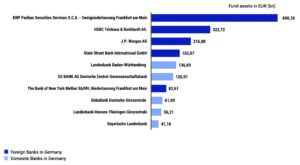

Custodians of securities funds (public funds)

The depositary business for mutual public securities funds in Germany continues to be led by a foreign bank in the year 2021.

Source: BVI Bundesverband Investment und Asset Management e.V.

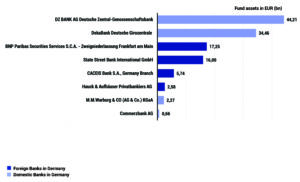

Custodians of securities funds (special funds)

Foreign banks continue to dominate the custody business for fund assets of German special securities funds in the year 2021.

Source: BVI Bundesverband Investment und Asset Management e.V.

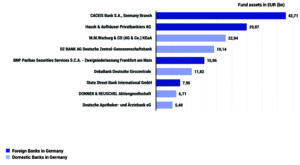

Custodians of open real estate funds (public funds)

In the year 2021, foreign banks continue to have a large market share in custody for open-ended mutual property funds, but the top positions are still held by German banks.

Source: BVI Bundesverband Investment und Asset Management e.V.

Custodians of open real estate funds (special funds)

Foreign banks continue to lead in the area of open-ended special real estate funds in the year of 2021.

Source: BVI Bundesverband Investment und Asset Management e.V.

M&A in Germany in the year 2021

The market for mergers and acquisitions continues to be firmly in the hands of the foreign banks, they account for nine out of ten of the most successful banks in this area.

Source: Dealogic – with kind support of Deloitte

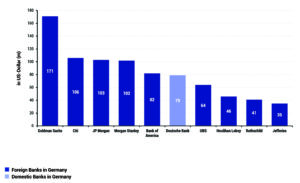

Investment banking fees in Germany in the year 2021

The market for mergers and acquisitions continues to be firmly in the hands of the foreign banks, they account for nine out of ten of the most successful banks in this area.

Source: Dealogic – with kind support of Deloitte

Stock exchange turnover of derivatives by issuers in the year 2021

The derivatives business in Germany continues to be dominated by foreign banks in the year 2021.

Source: Deutscher Derivate Verband